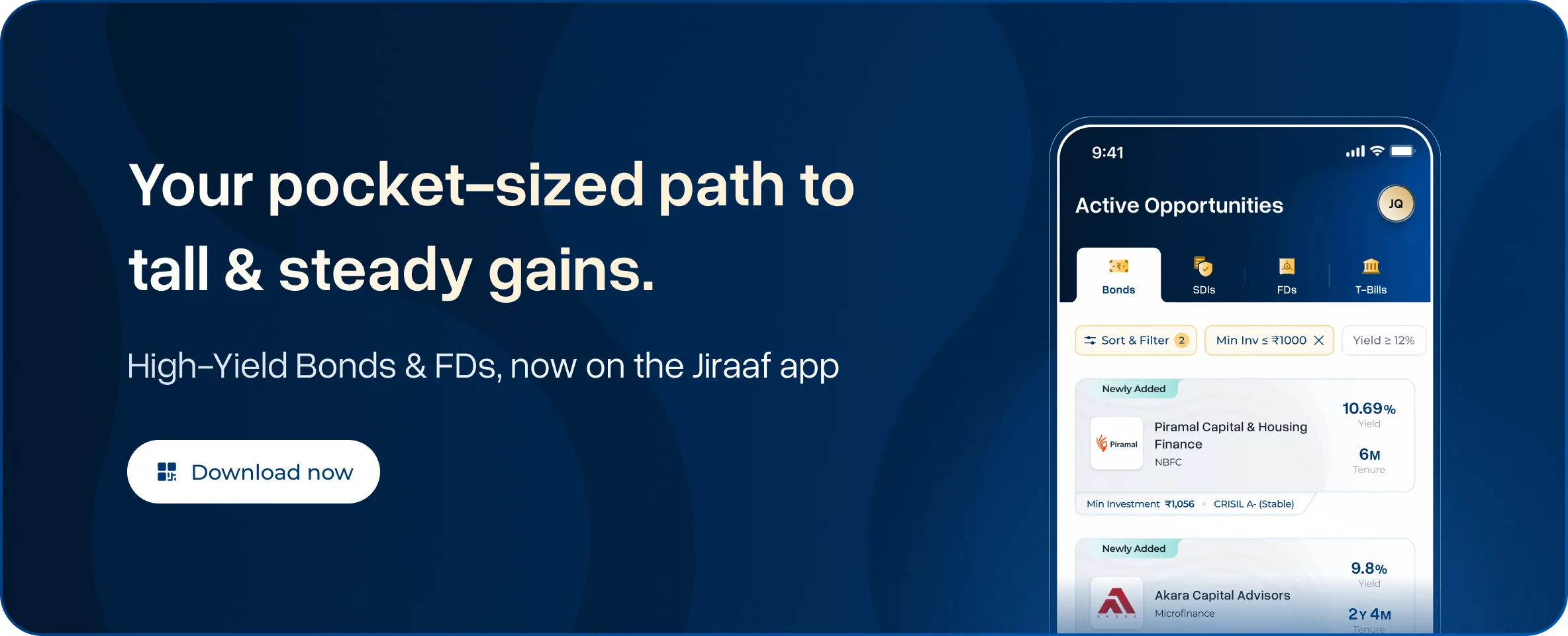

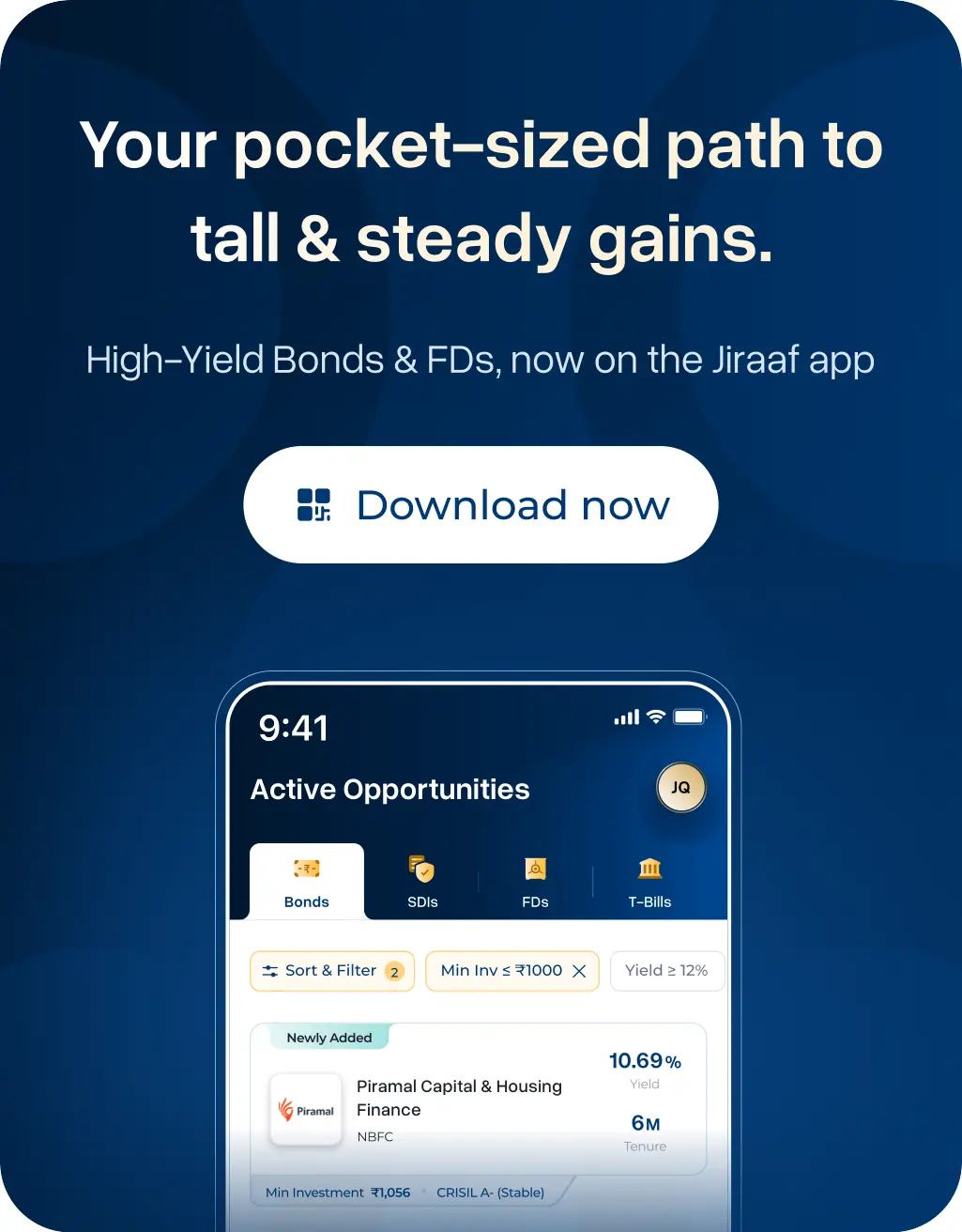

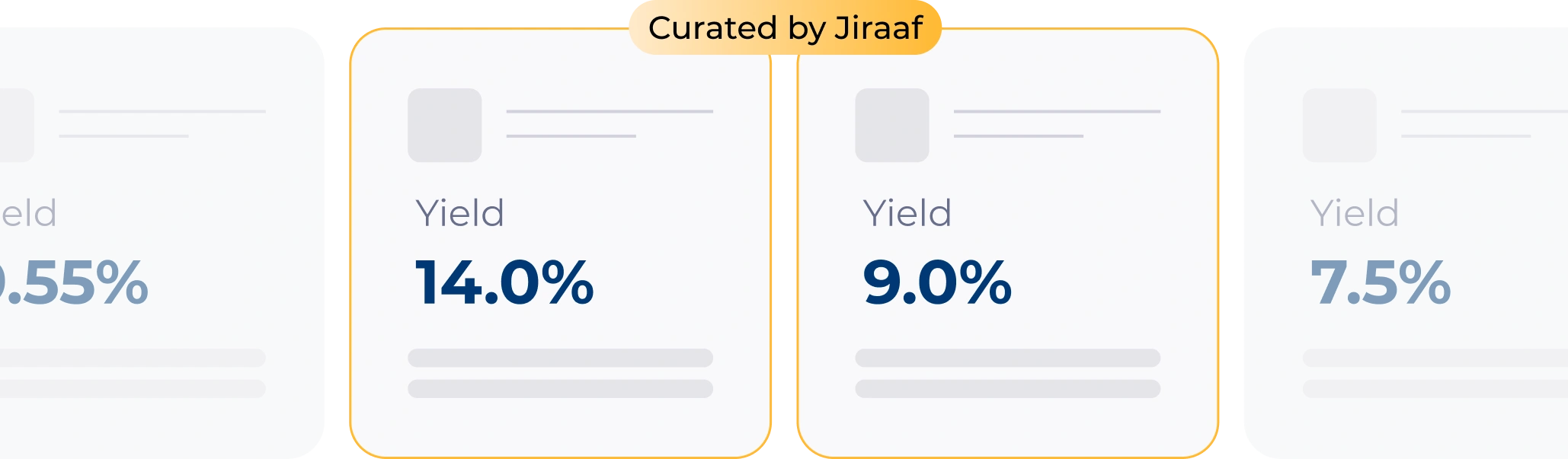

Explore handpicked bonds by Jiraaf

Festive Special

Profectus Capital Private Limited

A

10.60%

Yield

22M

Tenure

₹99,304

Min Investment

Interest

Monthly

Principal

At Maturity

Festive Special

Navi Finserv Limited

A

11.20%

Yield

17M

Tenure

₹9,969

Min Investment

Interest

Monthly

Principal

At Maturity

Festive Special

Muthoot Capital Services Ltd

A+

10.20%

Yield

15M

Tenure

₹71,827

Min Investment

Interest

Monthly

Principal

Per Schedule

Festive Special

Midland Microfin Limited

A-

12.30%

Yield

23M

Tenure

₹98,073

Min Investment

Interest

Monthly

Principal

At Maturity

Short Tenure

Pool of Invoice Receivables (PTC) Senior Tran...

A-

11.00%

Yield

103D

Tenure

₹1,09,771

Min Investment

Interest

At Maturity

Principal

At Maturity

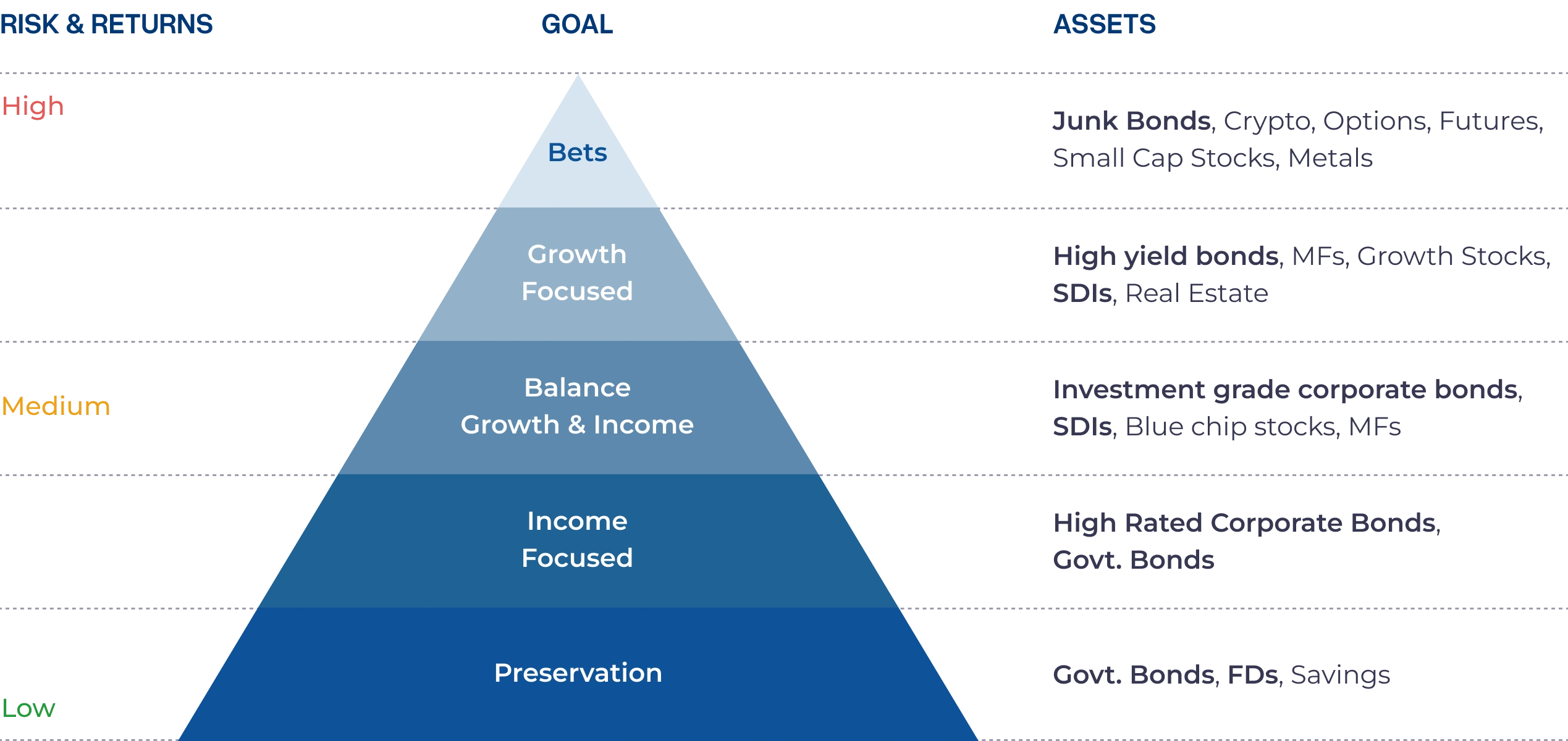

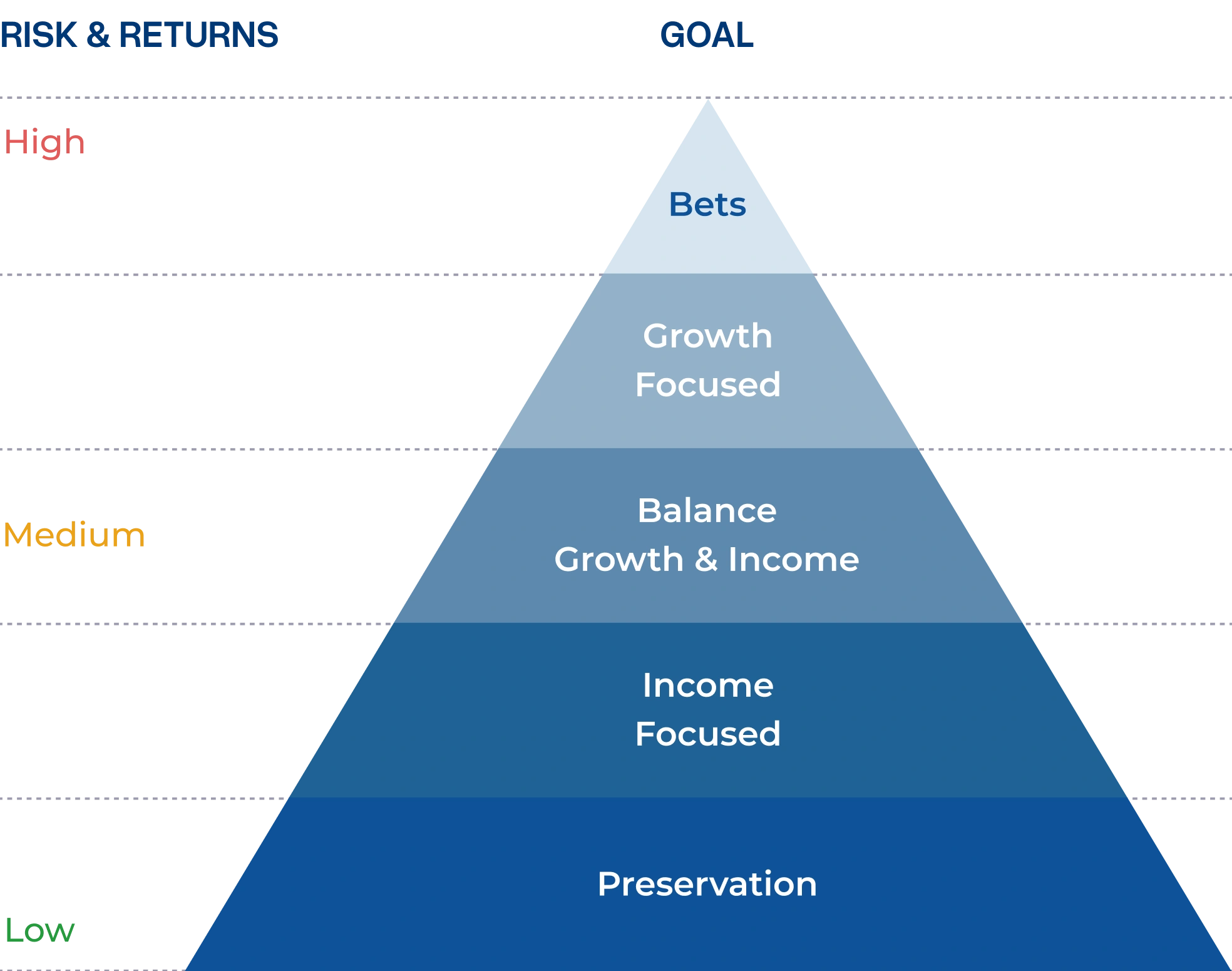

Bonds groove into every portfolio

Whatever your goal, age, or appetite for risk. No matter where you stand on the pyramid — there’s a bond for you.

Goal

Assets

Bets

Junk Bonds, Crypto, Options, Futures, Small Cap Stocks, Metals

Growth Focused

High yield bonds, MFs, Growth Stocks, SDIs, Real Estate

Balance Growth & Income

Investment grade corporate bonds, SDIs, Blue chip stocks, MFs

Income Focused

High Rated Corporate Bonds, Govt. Bonds

Preservation

Govt. Bonds, FDs, Savings

Why buy Bonds with Jiraaf?

Because stability isn’t just in our returns,

it’s in everything we do

it’s in everything we do

Curated with care, built for confidence

Risk-assessed fixed-income opportunities

Real support, not just bots

Dedicated relationship manager

We’ve seen it all, so you don’t have to

Expert team with 100+ years of experience

Total transparency

Easy access to every detail that matters

At Jiraaf, we don’t just offer investments — We equip you with smarter tools, deeper insights, and a more powerful way to grow your wealth

But hey, don’t listen to us.

Listen to our customers

Listen to our customers

Ready to join the club?

Start investing now

Start investing now

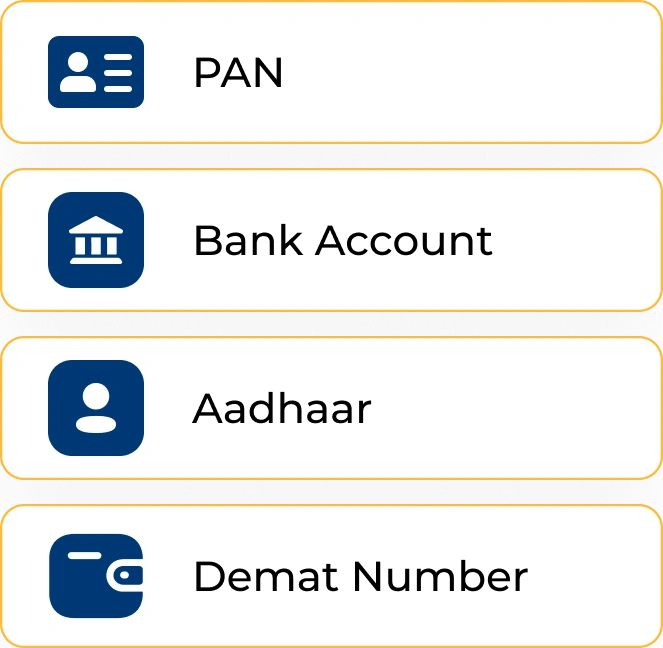

01

Complete paperless KYC online

02

Select from a curated list of opportunities

03

Complete payment and receive securities in your demat account

Keep these handy to effortlessly complete KYC. Your personal data is secure with us.

Complete paperless KYC online

Keep these handy to effortlessly complete KYC. Your personal data is secure with us.

Access detailed information enabling you to make an informed investment decision.

Select from a curated list of opportunities

Access detailed information enabling you to make an informed investment decision.

Transfer funds to clearing corporation and receive securities.

Complete payment and receive securities in your demat account

Transfer funds to clearing corporation and receive securities.

Learn more about bonds

Have the odds fall in your favour

Have the odds fall in your favour

Expert Insights

Bonds, Strategies & Smarter Investing

Webinars

On-Demand

On-Demand

Latest webinars to support your financial goals.

How PTCs (Pool of Trade Receivables) Can Enhance Your Fixed Income Portfolio

FD vs. Bonds- Your Money Deserves More | #Jiraaf Connect

Online Bond Platform Providers (OBPP) & Bond Investments: Key Benefits and FAQs | Exclusive Webinar

How PTCs (Pool of Trade Receivables) Can Enhance Your Fixed Income Portfolio

FD vs. Bonds- Your Money Deserves More | #Jiraaf Connect

Online Bond Platform Providers (OBPP) & Bond Investments: Key Benefits and FAQs | Exclusive Webinar

Looking for curated insights, industry trends, expert advice, and investment tips?

Backed by top investors

trusted by some of the most well known names in India

Siddharth Shah

Co-founder, Pharmeasy

Mankekar

Family Office

Capital - A

Venture Capital

Dharmil Sheth

Co-founder, Pharmeasy

Ramakant Sharma

Co-founder, LivSpace

Regulated framework for investing in bonds

Regulatory sales process for Bonds

All corporate bond investments follow the SEBI created framework for doing trades thereby improving transparency. All payments and bond unit allocations are directly dealt via SEBI regulated Clearing Houses.

Credit Rating

All listed bonds are rated by SEBI regulated external credit rating agencies. These agencies evaluate the financial strength of the borrower and their capacity to service and repay their debt. They assign different strength ratings to issuers thereby helping investors make educated decisions while investing.

Debenture Trustees

They are SEBI regulated entities and their primary job is to protect bondholders. They ensure that borrowers adhere to the issuance terms of the bond at all times and enforce the rights of bond holders if there is a breach by a bond issuer.

FAQs

What are Bonds?

Why invest in bonds?

Who can invest in bonds?

Where can I buy bonds in India?

What are the benefits of buying bonds online?

Is it safe to invest in bonds?